Short-Term Stock Market Outlook: All-Time Highs Could Be Reached Soon

The stock market outlook for the short term looks rosy. As it stands, it seems like bullish sentiment is prevailing and the stock market could go higher.

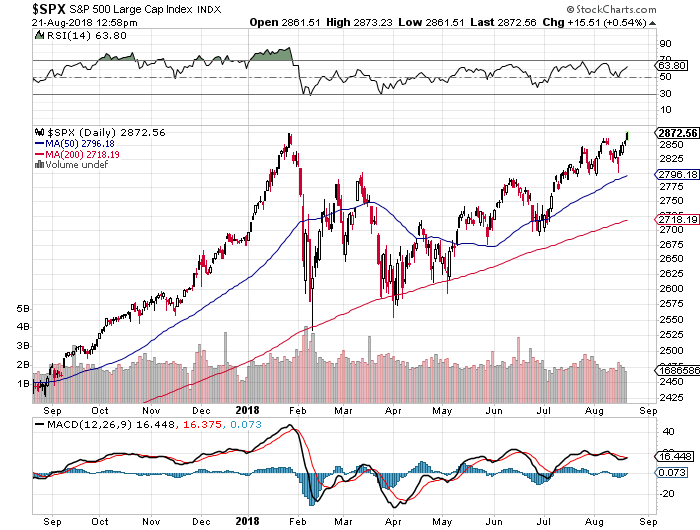

Just look at the chart below of the S&P 500 to get some idea of the current situation.

We are seeing the S&P 500 trade above its 50-day moving average and 200-day moving average. Mind you, the index found a lot of support at its 200-day moving average earlier.

At its core, the S&P 500 trading above these moving averages says that the short-term and intermediate-term trends on the stock market are pointing upward. This is bullish.

If you look at momentum indicators such as the moving average convergence/divergence (MACD) indicator, they are trending higher. This suggests that buyers are coming in, controlling the prices, and could take the stock market much higher.

Chart courtesy of StockCharts.com

Looking from a fundamental perspective, the short-term stock market outlook appears bullish. We see a few risks diminishing.

For example, earlier this year, investors were worried about a global trade war. That is on hold for now, giving investors some hope.

Earnings have been good lately, too.

So, looking at all this, it wouldn’t be shocking to see key stock indices like the S&P 500 march beyond their all-time highs sooner.

Great, right?

For the short term, yes, but don’t get too complacent.

Long-Term Stock Market Outlook: Stock Market Crash Is Possible

You’ll hear the mainstream media cheer when indices soar past their all-time highs (which is just a few percentage points away), but they will not tell you about how dangerous the long-term stock market outlook really is.

Mark my words, stock markets could be setting up to disappoint. The long-term stock market outlook is gruesome.

The upside moves in the short term could very limited. It must be asked whether stock markets can provide returns in the next five years that are similar to the returns in the last five years. It’s very hard to see this happening.

Understand that earnings growth is stalling and is expected to decelerate significantly into next year.

Valuations have become uber-expensive relative to the historical averages. If there’s one thing we know, it’s that valuations tend to come back to their historical average. If we see something like that happen, stock markets would have to drop a lot.

The U.S. economy may not be as strong as it is currently perceived. Don’t forget, stock markets tend to move ahead of the economy. If the economy faces headwinds, expect the key stock indices to face scrutiny.

Dear reader, be very careful. Don’t let the bullish short-term stock market outlook make you complacent.

The long-term outlook appears dismal as it stands. There are risks that shouldn’t be overlooked. A stock market crash shouldn’t be ruled out.

I have been saying this in these pages for a while now: capital preservation is very important for those who are investing for the long term.

The last few years have been great, so setting stop-losses on existing positions now may not be a bad idea. This could be really useful if markets drop unexpectedly. Remember, the last thing an investor would want to do is give away the gains accumulated over years. Stop-losses help secure gains.